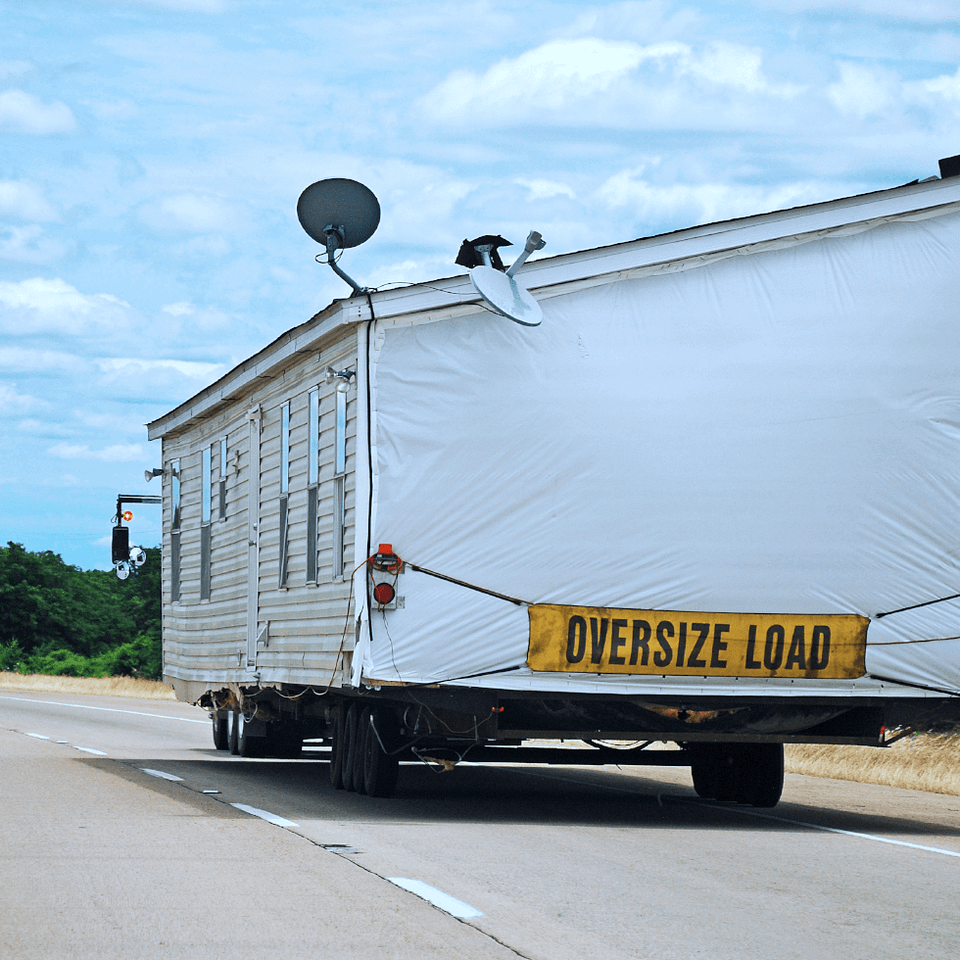

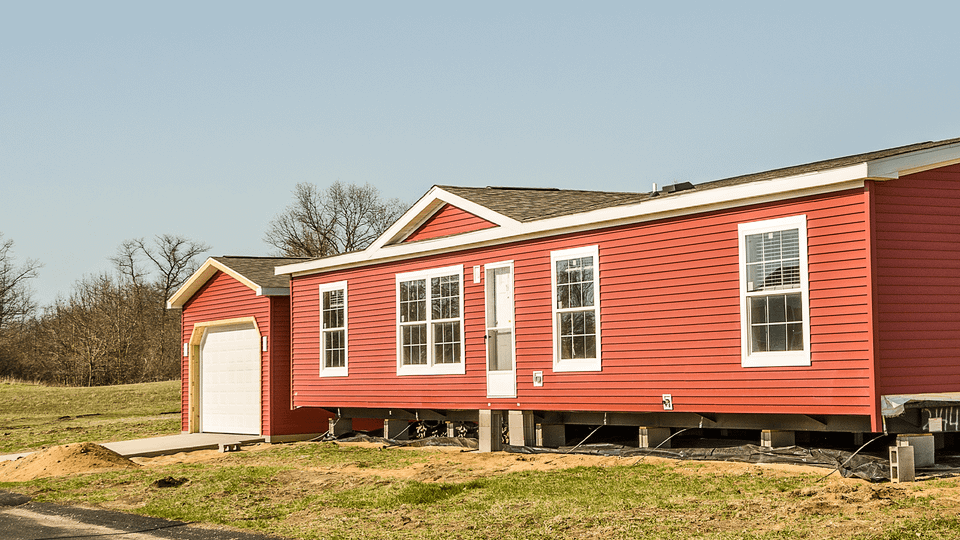

How much does it cost to insure a mobile home?

Similar to homeowners insurance, your cost will depend on the type of coverage you are getting. Many insurance companies offer good, better, and best options on mobile home coverage. This helps keep the payments affordable while giving you options on how broad you would like your coverage to be.