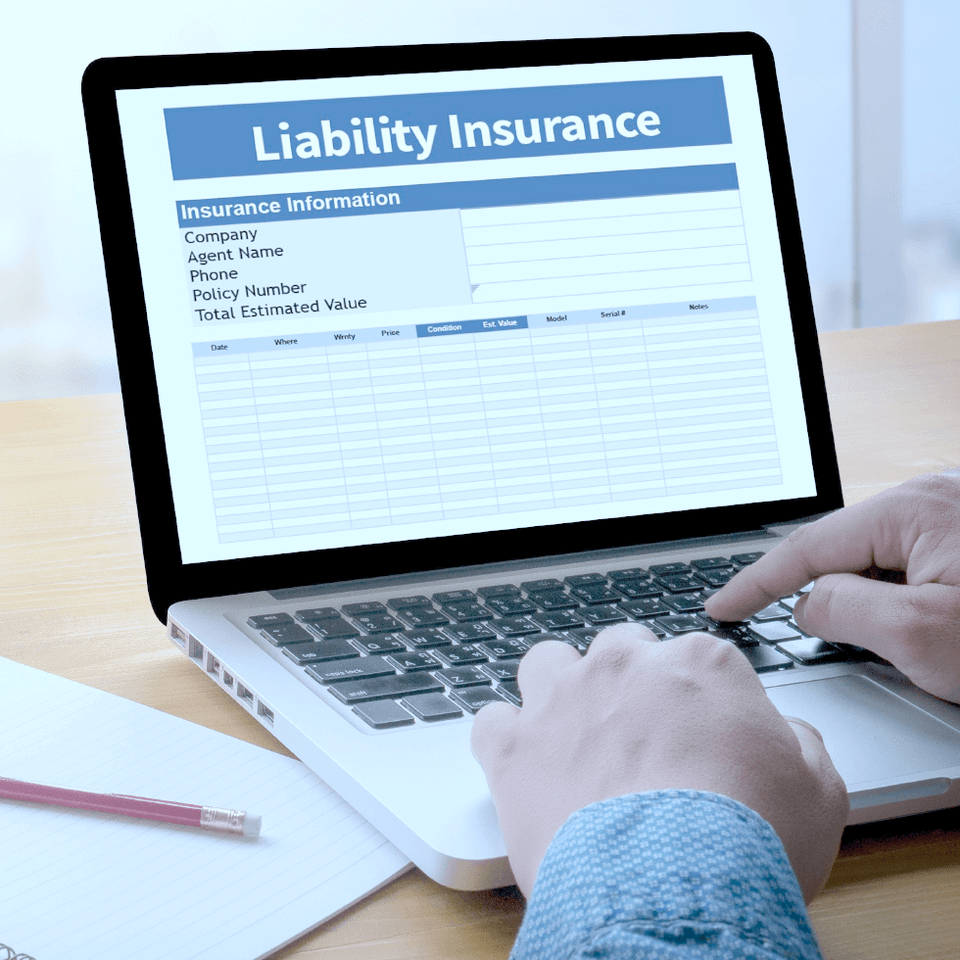

What is professional liability insurance?

Professional liability insurance, also known as medical malpractice or errors and omission (E&O) insurance, protects professionals against claims of negligence or malpractice. The special coverage from professional liability insurance is not included in your homeowners or business owners policies.

For example, a CrossFit instructor owns a gym and offers multiple training courses and fitness programs throughout the year. One day she's faced with a lawsuit from a participant in the training course. The woman filing the suit claims a personal injury from the directions of the instructor.

Professional liability insurance would cover the legal defense costs and settlement fees related to this claim. It doesn't matter if the CrossFit instructor was actually found liable for the injury.

For example, a CrossFit instructor owns a gym and offers multiple training courses and fitness programs throughout the year. One day she's faced with a lawsuit from a participant in the training course. The woman filing the suit claims a personal injury from the directions of the instructor.

Professional liability insurance would cover the legal defense costs and settlement fees related to this claim. It doesn't matter if the CrossFit instructor was actually found liable for the injury.